CXBOS Insights

Your daily dose of news, insights, and information.

Cheap Insurance: Because Why Pay More?

Unlock savings with cheap insurance! Discover tips to secure the best deals and never overpay again. Your wallet will thank you!

Top 5 Tips for Finding Affordable Insurance Without Compromising Coverage

Finding affordable insurance while ensuring adequate coverage can feel daunting, but it's entirely achievable with the right approach. Start by comparing quotes from multiple insurance providers. Websites like Insure.com and The Zebra allow users to compare rates and coverages side-by-side, giving you a clear view of your options. Once you have a list of potential insurers, don't hesitate to reach out and ask for discounts that may apply to you, such as for bundling policies or maintaining a safe driving record. Each small discount can add up, helping you save money while still enjoying comprehensive coverage.

Another important tip is to regularly review your policy and coverage needs. Life changes, such as moving, getting married, or acquiring new assets, can impact your insurance requirements. Adjusting your coverage as necessary can help you avoid overpaying. Additionally, consider raising your deductibles; this often leads to lower monthly premiums. Remember, however, to keep your emergency savings in mind when setting your deductible. For more tips on adjusting coverage responsibly, visit Nolo.com. By staying proactive and informed, you can successfully navigate the insurance landscape without sacrificing essential protection.

Is Cheap Insurance Worth It? Understanding the Pros and Cons

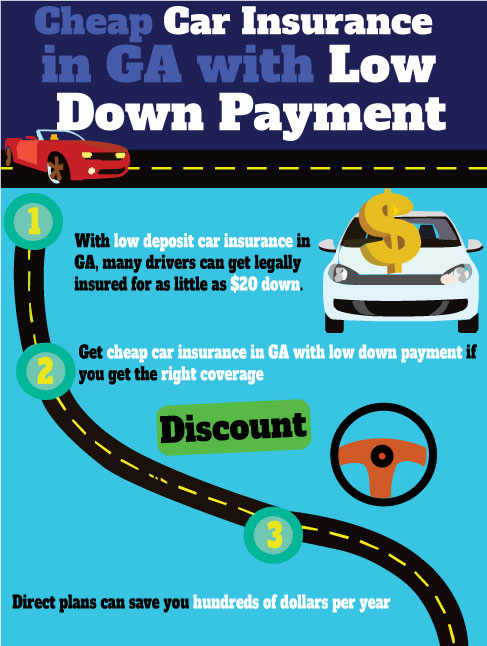

When considering cheap insurance, it’s essential to weigh both the benefits and drawbacks. One of the main advantages is cost savings; lower premiums can make insurance more accessible, especially for young drivers or those with tight budgets. According to Nationwide, affordable plans can help ensure that you have basic coverage to meet legal requirements. However, it’s crucial to evaluate the coverage limits and deductibles that come with these cheaper policies, as they might leave you underinsured in the event of a significant claim.

On the flip side, cheap insurance often comes with certain compromises. Policies might lack comprehensive coverage options or have lower payout limits, which could be financially devastating in an accident or unexpected event. A report from Consumer Reports highlights that while saving money is appealing, it’s vital to assess whether the savings are worth the risk of potentially facing high costs later. To make an informed decision, it's recommended to carefully read the policy details and consider your personal needs and circumstances.

How to Compare Low-Cost Insurance Plans: A Step-by-Step Guide

When it comes to finding the best low-cost insurance plans, the first step is to gather information about the available options. Start by visiting reputable comparison websites such as Insurance.com or Policygenius. By entering your details, these platforms will provide you with a range of quotes from various insurers. Make sure to note down key details such as coverage limits, deductibles, and premiums. Additionally, reading customer reviews on sites like InsuranceRating.com will give you insights into customer satisfaction and service quality.

After gathering your quotes, it's crucial to compare the plans side by side. Create a simple spreadsheet to organize the information, and include columns for each policy's features, exclusions, and costs. Pay special attention to the coverage types you need most, such as liability, comprehensive, or collision coverage. Don't forget to check for any available discounts that can affect your final premium. Once you've completed your comparison, you’ll be better equipped to choose a plan that offers the best balance of affordability and adequate coverage.