CXBOS Insights

Your daily dose of news, insights, and information.

Quote Quest: Navigating the Insurance Maze

Unlock the secrets to insurance with Quote Quest! Master the maze and find the best policies that suit your needs today!

Understanding Different Types of Insurance: A Beginner's Guide

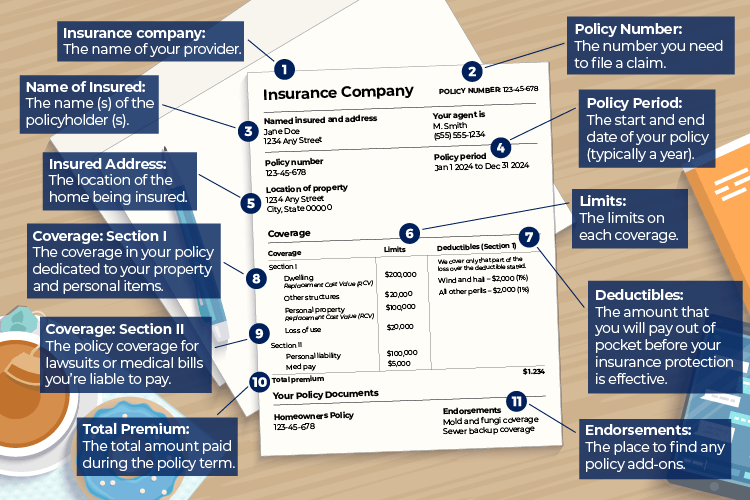

Insurance can often feel overwhelming, especially for beginners. However, understanding the different types of insurance is essential for protecting yourself and your assets. Health insurance covers medical expenses for illnesses, injuries, and preventive care, while auto insurance financially protects you in case of accidents involving your vehicle. Additionally, there are various other types of insurance, including homeowners insurance, which safeguards your home and possessions from damages or theft, and life insurance, which provides financial support to your beneficiaries after your passing.

As you begin to explore the world of insurance, it's helpful to categorize it into a few main types: Property insurance, which protects personal belongings; Liability insurance, which covers legal costs if you're found responsible for causing harm; and Disability insurance, which provides income in case you're unable to work due to an injury or illness. Understanding these categories can help you make informed decisions and choose the right insurance plans to suit your individual needs.

Top 5 Common Insurance Myths Debunked

When it comes to insurance, misinformation often leads to confusion and costly mistakes. To help you navigate this complex landscape, we’ve compiled a list of the top 5 common insurance myths that need debunking. Understanding the truth behind these myths can save you time, money, and unnecessary stress.

- Myth 1: All insurance policies are the same.

- Myth 2: I don't need insurance if I’m healthy.

- Myth 3: Insurance is too expensive for me.

- Myth 4: My coverage will protect me in any situation.

- Myth 5: Insurance agents are only in it for the commission.

By dispelling these myths, you can make more informed decisions about your coverage and ensure that you are adequately protected.

How to Choose the Right Insurance Coverage for Your Needs

Choosing the right insurance coverage for your needs can feel overwhelming, but understanding your options is the key to making an informed decision. Start by assessing your individual requirements, which can vary based on factors such as your age, profession, health status, and financial situation. Create a list of essential coverage types, such as health insurance, auto insurance, or homeowners insurance, and consider how much coverage you realistically need for each category.

Next, it’s crucial to compare different policies and providers. Pay attention to the premium costs, deductibles, and policy limits of each option. You may want to use a comparison tool or consult with an insurance agent to better understand the specifics of each coverage type. Additionally, don’t forget to consider customer service ratings and the financial stability of the insurance company. This comprehensive approach will help ensure you select the right insurance coverage that aligns with your needs and provides peace of mind.